reverse tax calculator nj

Reverse Tax Calculator Is A Simple Financial App That Allows You To Quickly And Easily Figure Out Just How Much Of That Sales Total Was Actually Taxes. Local tax rates in New Jersey range from 000 making the sales tax range in New Jersey 663.

The Official Website Of The Town Of Guttenberg Nj News

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

. New Jersey has a 6625 statewide sales tax rate but also has 309 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of. See the article. 52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you.

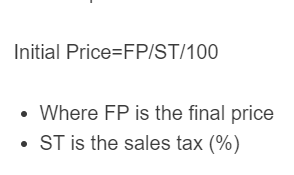

As we can see the sale tax amount equal to 5000 which the same to above calculation. Here is how the total is calculated before sales tax. Sale Tax total.

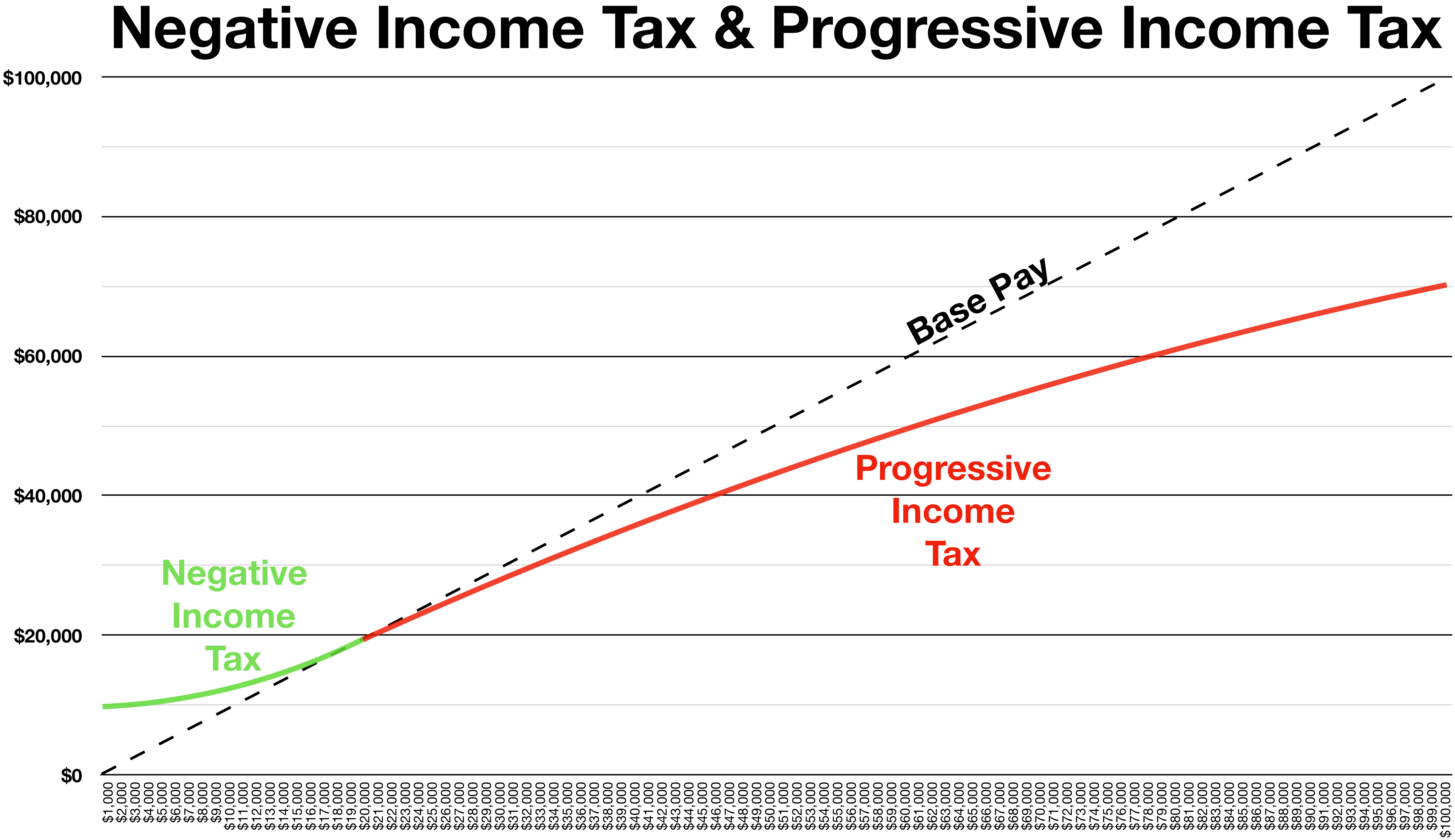

SmartAssets New Jersey paycheck calculator shows your hourly and salary income after federal state and local taxes. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as. Reverse Sales Tax Calculations.

Net Income - Please enter the amount of Take Home Pay you require. To make things simple you can also depend on the reverse percentage calculator. Your average tax rate is 1198 and your marginal.

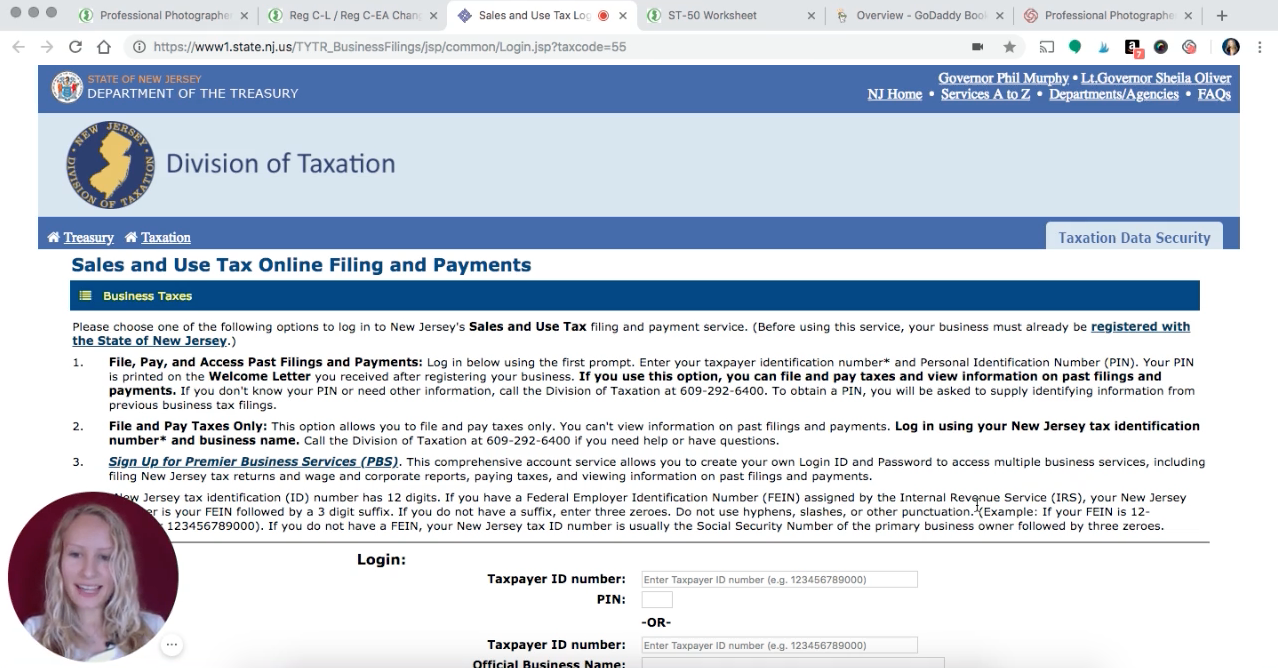

Free Get in Store app Description Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes. New Jersey Income Tax Calculator 2021. Sales and Use Tax.

Margin of error for HST sales tax. Due to rounding of the amount without. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish.

Amount without sales tax qst rate qst amount. Sales and Gross Receipts Taxes in New Jersey amounts to 163. Find your New Jersey combined.

The base state sales tax rate in New Jersey is 6625. If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783. Reverse Tax Calculator Gst.

The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. Tax Year - Select the Tax Year to calculate tax years start 6th April and end 5th April. The invoice bill to the customer will be 105000 100000 5000 and it is known as the total sale include tax.

To figure out how much gst was included in the. An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax. Enter your info to see your take home pay.

This is the NET amount. It simplifies the process so all. The reverse sale tax will be calculated as following.

New Brunswick Newfoundland and Labrador Nova Scotia. The average cumulative sales tax rate in the state of new jersey is 663. To find the original price of an item you need.

X 100 Y result.

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Seattle Sales Tax Rate And Calculator 2021 Wise

New York State Income Tax Compared To New Jersey Income Tax

Collecting Nj Sales Tax As A Photographer Lin Pernille

How To Calculate Sales Tax In Excel

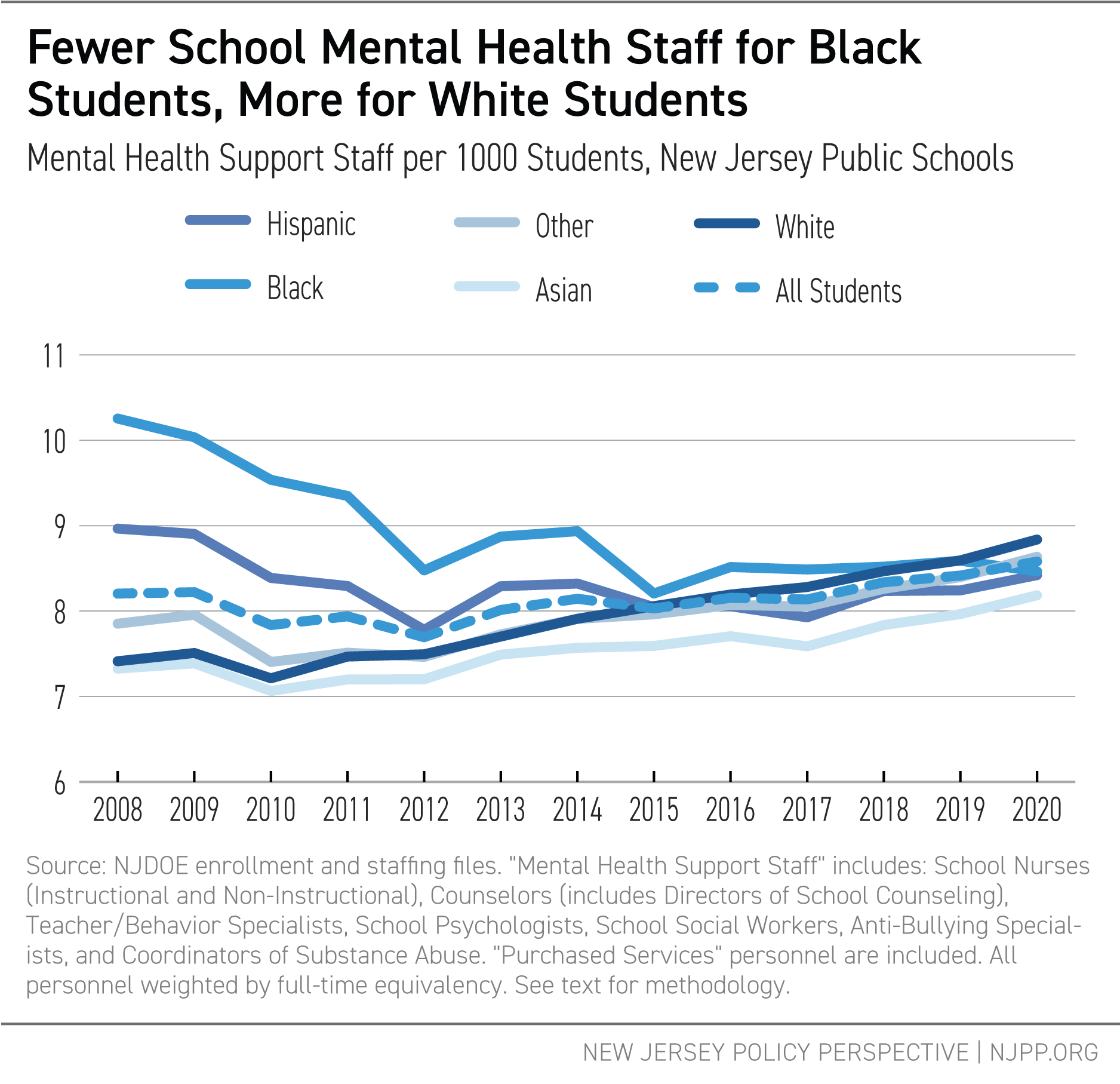

Report Archives New Jersey Policy Perspective

Reverse Sales Tax Calculator Calculator Academy

Us Sales Tax Calculator Reverse Sales Dremployee

Mortgage Calculator Free House Payment Estimate Zillow

Illinois 2022 Sales Tax Calculator Rate Lookup Tool Avalara

The Official Website Of The Town Of West New York Nj Tax

Sales Tax Calculator Reverse Sales Tax Calculator

Quarterly Tax Calculator Calculate Estimated Taxes

Reverse Sales And Use Tax Audits The Most Frequently Asked Questions

Reverse Sales Tax Calculator 100 Free Calculators Io